12% Club App Review by BharatPe (Ashneer Grover)

Investing can be a confusing and overwhelming process for many people, especially those new to the finance world. With so many options and so much information to digest, it can be difficult to know where to start. That’s where the 12% Club app comes in – a cutting-edge investment platform that promises to make investing simple and accessible to everyone.

This article will take a comprehensive look at the 12% Club app, exploring its features, benefits, and drawbacks. We’ll also share our thoughts on whether it’s the right investment platform for you.

What is the 12% Club App?

The 12% Club app is a revolutionary investment platform that allows users to invest. However, the app uses a proprietary algorithm to analyze financial data and market trends and makes investment recommendations based on this information. The goal is to help users achieve a 12% annual investment return. 12% Club App Made By BharatPe Company owned by Ashneer Grover.

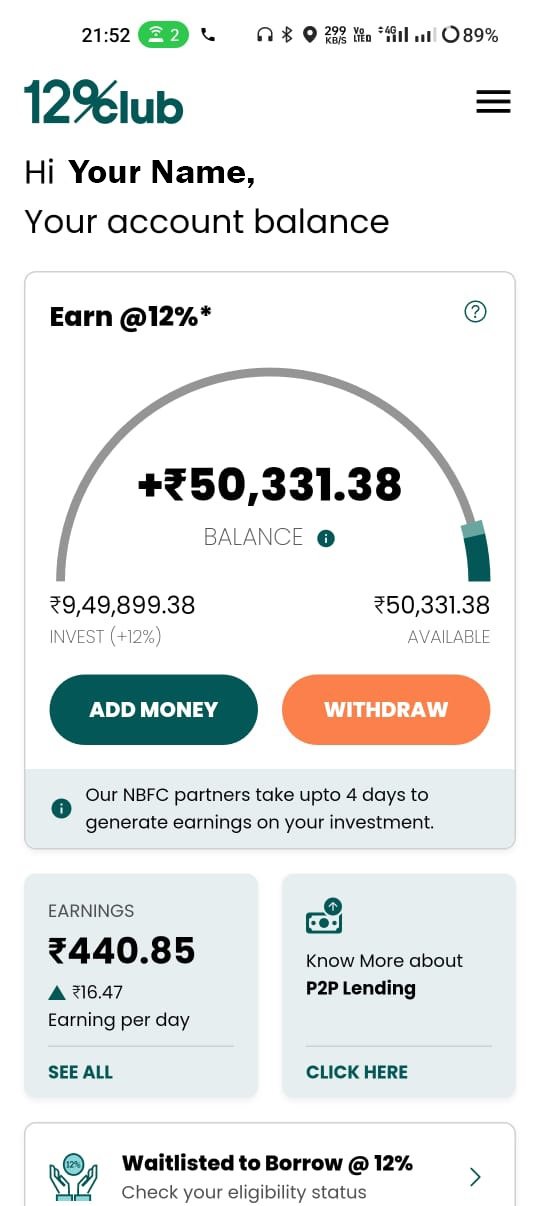

Earn Per Day by 12% Club

12% Club Gives you a daily return on your total investment if you invested 1,00,000 Then You will earn 32.88 INR Daily and it will credit to your 12% Club App and You can Withraw Whenever You Want. You can calculate your Earning.

Features and Benefits of 12% Club App

The 12% Club app offers a range of features and benefits that set it apart from other investment platforms. Here are some of the key highlights:

Easy to Use:

The app is designed to be user-friendly and intuitive, with a simple interface. Users can easily navigate their portfolios, view their investments, and make trades with just a few taps.

Diversified Portfolio:

The 12% Club app invests in a diversified portfolio peer to peer, and more which helps to minimize risk and increase returns. This is a key advantage for those new to investing who want to avoid dealing with the complexity of creating and managing a diversified portfolio.

Professional Management:

The app’s proprietary algorithm is designed by a team of financial experts who constantly monitor market conditions and adjust the portfolio accordingly. This means that users don’t have to worry about monitoring their investments or changing their portfolios.

Affordable:

The 12% Club app is an affordable investment platform with a low minimum investment requirement of just 1,000 INR. This makes it accessible to a wider range of people, including those just starting with investing.

Drawbacks and Limitations of 12% Club App

While the 12% Club app offers many benefits, there are also some drawbacks and limitations that users should be aware of. Here are some of the key considerations:

Limited Investment Options:

The app only allows users to invest up to 1,000,000 INR. Users cannot invest in other assets, such as real estate, commodities, or alternative investments.

No Customization:

The app’s portfolio is pre-set and cannot be customized. While this makes the app simple and easy to use, it may only suit some with specific investment goals or preferences.

Is the 12% Club App Right for You?

Whether the 12% Club app is right depends on your investment goals, risk tolerance, and personal preferences. Here are some of the factors to consider:

Ideal for Beginners:

The app is designed to be simple and user-friendly, making it an excellent option for those new to investing. Its automated approach and professional management can help take the stress out of investing, allowing users to focus on other things.

Hands-Off Approach:

If you’re looking for a passive investment option requiring little to no involvement, the 12% Club app may be a good choice. Its automated approach takes care of the heavy lifting, allowing you to sit back and watch your investments grow.

Limited Customization:

There may be better choices than the 12% Club app if you have specific investment goals or preferences. Its pre-set portfolio and limited investment options mean you will need more time to customize your investments to meet your needs.

Conclusion:

The 12% Club app is a cutting-edge investment platform that promises to make investing simple and accessible to everyone. Its user-friendly interface, professional management, and automated approach make it an attractive option for those new to investing or looking for a hands-off approach. However, its limited investment options and a pre-set portfolio may not be suitable for those who have specific investment goals or preferences.

Before investing with the 12% Club app, it’s essential to carefully consider your investment goals, risk tolerance, and personal preferences. By doing so, you can ensure that you choose the right investment platform for your needs and achieve the financial success you’re after.

Alternative

- Mobikwik Xtra – Earn Up to 12.99% p.a. with Mobikwik Xtra

- Top and Best p2p Lending Platforms